Have you ever sat at your work desk and wondered if you were missing out on an entirely different lifestyle? Did the stay at home COVID order allow your brain to realize life doesn’t have to be centered around a 9-5 job? OURS DID! We made the jump in April 2021 by leaving our automotive corporate positions to live in a van. Traveling for a living sounds like a dream but there is definitely a transition period going from a steady income to living in a van full time. I will list out everything you need to know in this How To Go from Corporate America to Van Life blog.

How to Go From Corporate America to Van Life Agenda

- Business Plan for Income

- Create a Budget

- Pick the Right Van for You

- Motorhome Insurance & Towing Service

- Health & Dental Insurance

- 401K Rollover

- Reduce Belongings and Invest in Quality Compact Items

Business Plan for Income

Since you are reading this blog you are more than likely looking to quit your corporate position. Nine to five jobs aren’t for everyone but we can all agree they do supply consistent incomes. It can be really scary leaving the security of that income but having a plan in place should make it less painful. Before you give the bad news to your boss make sure you have made a realistic business plan for your income streams.

We made a 130 Page Powerpoint Business Plan for our social media business, “Faris and Lisa”. Here are some ideas to make your own business plan:

Business Plan Template

- Industry Analytics utilizing third party market research – utilize Google, YouTube, and Books

- Competition – Look at who is already in that industry

- What are they doing well? How can you utilize this data?

- What are they doing poorly? Can you refrain from doing these actions?

- Is there room for you in this Category?

- What makes you special compared to others?

- Marketing and Advertising – How will you get your brand out there

- What social media platforms work best for your industry? Do you have time for 4 platforms or should you only focus on 2?

- Can a blog help promote your business?

- Will word of mouth be enough?

- Monetization – How are people in your industry making money?

- Is there more than one revenue stream? Should you prioritize your time on one more than the other?

- Passive income vs Active income – are you able to do both?

- Budget – What are people in your industry spending on?

- How much do you have saved?

- What are your fixed costs and variable costs? Can you reduce your variable?

- SWOT Analysis – Understand your own Strengths, Weaknesses, Opportunities, and Threats

- Mission and Vision Statement – What is the future of your business and how will you get there?

- Short Term and Long Term Strategy

- 1-2 Month Strategy

- Quit Jobs

- Income and Budget Forecast

- Branding

- Van Travel Schedule

- 6 Month Strategy

- 1 Year Strategy

- 2-3 Year Strategy

- 5 Year Strategy

- 1-2 Month Strategy

Create a Budget

Create a realistic budget for yourself based on the income you are projecting. If you are quitting your job in order to start your own business chances are your income for the first year will be lower than you are used to. Reduce your spending to reflect your new income level. Remember to include personal expenses like weddings, birthday gifts, haircuts, makeup, etc. We track our spending by day in order to stay on budget and share with you guys! Below are some of the things we include in our budget:

- Savings Accounts less costs

- One time lump some costs

- Personal

- Business

- Monthly Fixed Costs

- Living Costs x 12 Months

- Business Expenses x 12 Months

- Monthly Variable Costs

- Living Costs x 12 Months

- Business Expenses x 12 Months

- One time lump some costs

Pick the Right Van for You

Now that you’ve made a business plan for your income and created a budget for your new van life, you understand the amount of money you can spend on the van.

If you are looking to finance your van do note the differences between an auto loan vs a motorhome loan. An auto loan length is typically around 6-8 years vs a Motorhome at 20 years. So if you are looking to build out your own van you will more than likely get an auto loan. If you buy a finished van from an RV Dealer you will get a motorhome loan. Since we only plan to have the van for a few years the motorhome loan was attractive to us. You could also work out a personal loan with your bank if you wanted to go that route.

Before making any impulse buys make a list of all the things you will need out of a van. There are plenty of different vans you can build out yourself or purchase finished. Once you complete your list it will help narrow the choices down.

Our must have list led us to the Winnebago Revel, which we purchased from General RV. The 4WD and finished van really narrowed the list down since the Ford Transit and Revel were the only two with these options.

Faris and Lisa Van Must Haves

- Finished Product

- 4WD – Ability to off-road

- Diesel Fuel

- Wet Bath – Closed off shower/bathroom for privacy

- 2 comfortable work spaces

Motorhome Insurance and Towing Service

Motorhome Insurance

If you currently have auto insurance you can purchase motorhome insurance from the same provider. We have found that Progressive seems to be the cheapest for Auto and Motorhome. You can go ahead and get a free quote now on their website.

We went through an Insurance Agent at General RV, where we bought our van. The insurance agent goes through all the motorhome policies and finds the cheapest plan catered to you. We did the free quote on Progressive and the insurance agent came back with the same quote but had more benefits and we were able to get our valuables insured as well. Overall, the cost came to $1,668 annually.

Towing Service

Along with motorhome insurance you should consider a towing service since some insurance plans do not include this. It was important for us to get a towing service since we plan on driving all over the US, Canada, and maybe Mexico. Another deciding factor was the lack of Mercedes Sprinter Service Shops in the US. It is much easier to get a Ford or Dodge van serviced at any shop vs a Mercedes needs specialty parts and can only be serviced at Mercedes Specialty Dealers. The towing service provides us with peace of mind. We signed up for Coach-Net at General RV, where they gave us at discounted price at $4 a month.

Health and Dental Insurance

COBRA

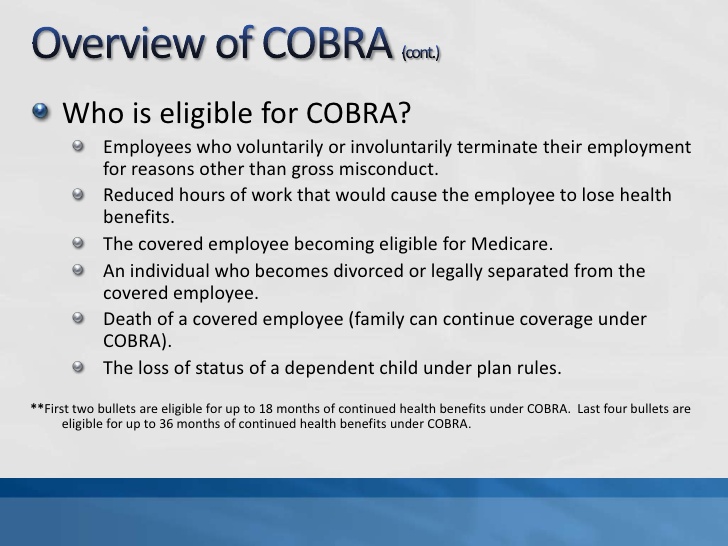

If you plan to quit your corporate position this means Health and Dental Insurance plans will stop on your last day of the job unless you decide to continue these plans through COBRA. COBRA stands for Consolidated Omnibus Budget Reconciliation Act of 1985 and it mandates an insurance program that gives employees the option to continue health insurance coverage after leaving employment.

Once you quit you will receive a COBRA package that will outline the benefits you received when employed and the new full price of the insurance. It’s commonly known that COBRA is expensive! We were shocked to see the prices, so we declined the COBRA coverage and went to the healthcare marketplace instead.

Health / Dental Insurance Marketplace

The Health Insurance Marketplace is an online platform where you can purchase health and dental insurance (Policies and regulations differ state by state – this blog section is based on Michigan rules). Typically enrollment is only one time a year, but if you quit your job you qualify for special enrollment due to a life change. The marketplace will subsidize health care for the following annual income levels:

- Personal: $12,490 – $49,960

- Family of three: $21,330 – $85,320

If you are starting up a new business and plan for little income in the first year this may be a great option for you. Just note if you make more than what you put down on your application you will have to pay money back at the end of the year. You can still purchase healthcare from the marketplace if you are making more than the above numbers.

401K Rollover

Both Faris and I invested into 401Ks and Roths at our corporate positions since they provided matching programs. Once you quit all matching stops so it doesn’t make sense to keep your investments in these accounts. Instead we called our investment providers and moved the 401Ks and Roth accounts into two separate IRAs so we can continue to invest at a better return rate. We have Fidelity and Vanguard, they will only take a small percentage of your return as payment.

Reduce Belongings and Invest in Quality Compact Items

Reduce Belongings

Moving into a van means you have no choice but to reduce your belongings. Depending on your current personal situation this can be a big life change like selling your house and getting rid of all bulky items such as furniture, sets of kitchen pots and pans, grills, etc.

Faris and I were living together in a house he bought in 2016 and then he sold the house in July of 2020. We got rid of a majority of our furniture and major large items. The rest we moved into a storage unit, which we only paid to have for a month.

Our plan was to move into an apartment in a downtown area. The apartment was still under construction but had a finish date of September 2020. During the mean time we moved into my parent’s house. COVID slowed everything down and drastically changed our plans. Ten months later… we finally moved out of my rent’s house and into the van!

Invest in Quality Compact Items

Some vans have better storage options than others. Ours for example has very limited storage space. I actually purchased custom sized bins for our clothes to fit in a small cubby above the driver and passenger seat. Faris and I only get two 12.25″ x 10.5″ x 7.5″ boxes that we fit all of our clothes into. It’s not much room at all so every item of clothing has to serve a multi-use purpose.

I recommend selling or donating all the things you don’t need and investing into high quality products and materials since they will be getting so much wear and tear. Some examples include pans with removable handles, mini quality vacuum, high thread count silky sheets for hot nights, and Moreno wool socks for hiking!

How To Go From Corporate America to Van Life Conclusion

Now you can stop daydreaming about the nomadic lifestyle and make it a reality! Going from Corporate America to Van Life can be nerve-wrecking but as long as you have a plan and set clear expectations you should be successful. If you enjoyed this “How To Go From Corporate America to Van Life” Blog make sure to check out our YouTube Channel and other blogs.

- Faris and Lisa YouTube Channel – New Videos every Monday and Thursday

- Faris and Lisa Van Life Blogs and Destination Page